Consumerism can be defined as increasing consumption of goods and services being economically desirable. The belief being that increasing levels of spending, rather than saving, leads to a greater level of GDP.

India has a significant opportunity in consumerism due to its demographic dividend and the emergence of its middle class as a consumer. In this note we illustrate the opportunity, which can be leveraged by companies operating in India.

DEMOGRAPHIC DIVIDEND

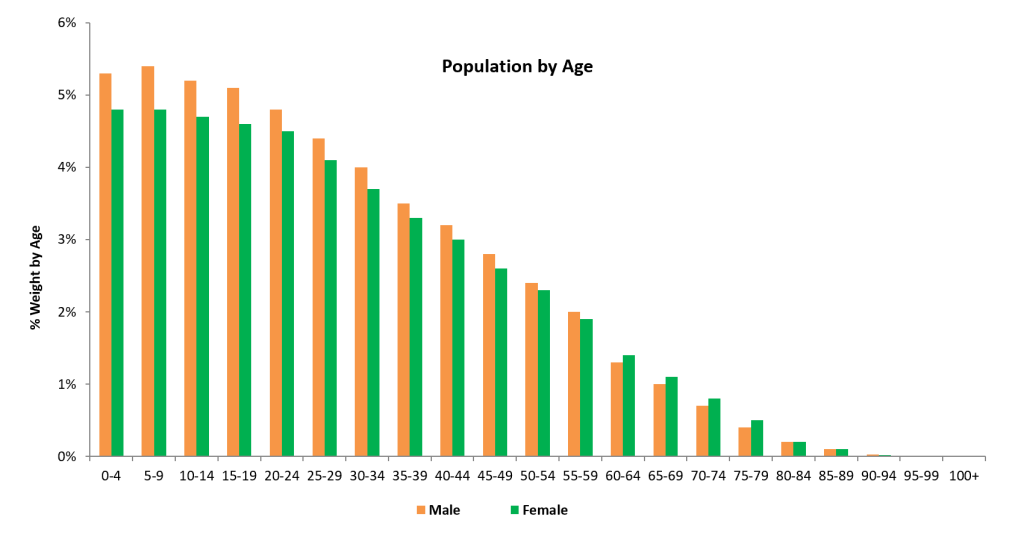

Figure 1: Population by age

Source: populationpyramid.net

The population profile of India provides significant insight into the opportunity available for businesses. Approximately 50% of the population is below the age of 25 and 78% is below the age of 45. This age structure creates a “demographic dividend” which refers to the fact that a substantial proportion of the population is working age (i.e. 15-64 is 65%) with the opportunity to be productive.

However, a large population on its own does not create the opportunity for profit without focused policy and reforms, particularly to absorb a rapidly growing workforce. The Government of India understands the need for focus on education, healthcare and financial inclusion, particularly in Tier 2 and 3 cities.

Critical in cultivating the demographic dividend, is the need to develop skills through better education, thereby improving productivity, given the expectation of a global shortfall in skilled labour.

HOUSEHOLD SAVINGS RATE

Figure 2: Indian Household Savings

HOUSEHOLD SAVINGS RATE

Figure 2: Indian Household Savings

Source: tradingeconomics.com

India’s household saving rate is over 30% of disposable income, which is representative of Asia’s cultural propensity to save in general. Contrast this to the savings rate of the US (4%), Japan (sub 1%), Europe (7%), UK (4%) and Australia (9%)[1] and it is easy to understand the potential consumption spending power of a youthful and vibrant India, particularly given the focus on job creation by the Modi Government. If oil prices continue to remain low and inflation recedes, it provides the opportunity for lower interest rates, which stimulates spending and credit growth. This is likely to benefit several consumption oriented companies over the next 3-5 years in particular.RISING MIDDLE CLASS

According to NCAER, India’s middle class population by 2025-26, will more than double from 2015-16 levels to reach 114mn households or 547mn individuals. This is close to twice the population of the United States! The NCAER report also stated that whilst the middle class was only 13% of the Indian population, it in fact owned 49% of cars, 21% of TV’s, 53% of computers and 46% of credit cards. The report forecasts that the middle class would constitute 20% of the population by 2015-2016 and over 30% by 2025-2026[2].

In fact, according to Mckinsey Global Institute, middle and affluent classes in India will contribute 80% of total consumption by 2025, up from 25% in 2005 and 55% in 2015[3].

Projects like “Make in India”, where the Modi Government is focused on bringing manufacturing back to India through research and development and improving the ease of doing business for foreign companies, are likely to provide ample opportunity for job creation. A young, working age demographic, coupled with increased skilled employment creates a powerful tailwind for increasing consumption.

CONSUMPTION OPPORTUNITY

India’s consumer market, buoyed by a strong economy, rising household income and socioeconomic forces, is likely to see the size of consumer spending increase from USD$1trillion in 2010 to USD$3.6trillion by 2020, according to a study done by Boston Consulting Group in 2012[4]. And this forecast was made prior to Modi’s election win! This presents significant opportunity for local and foreign manufacturers and retailers to benefit from increasing spending power.

However, one of the battles for these companies is the requirement to re-brand their product base for the Indian consumer. Price is one of the key drivers of demand given much of India still remains rural and classified as poor. The product set needs to take into account limited supplies of electricity, water and other amenities as well as the high propensity to save. For example a washing machine manufacturer has to consider water shortage, cost of electricity, required usage and most importantly price point before considering the growth opportunity.

Car manufacturers also face a significant opportunity given that the rising middle class is likely to consider a purchase of an automobile for the first time. Current two-wheelers dominate the market because of price point, fuel costs, traffic and space. However, given the right product and price point the opportunity remains significant for auto manufacturers, particularly local companies like Maruti Suzuki, Tata Motors, Mahindra & Mahindra and Ashok Leyland to name some.

Other industries likely to benefit from the consumerism theme include Food and Beverages, Clothing and Footwear, Alcohol and Tobacco, Household Goods, Education, Transport, Communications Healthcare, Housing, Hotels and Leisure.

TECHNOLOGY AND SOCIAL MEDIA

The rise of social media and technology has also had an impact on the Indian consumer to spend. Social media has benefitted companies to create greater brand awareness, particularly in Tier 1 and 2 cities where wealth is more significant and internet penetration is high.

INDIA AVENUE OPINION

- Consumerism is inevitable in India as trends towards urbanisation, increasing consumption and increasing employment take hold.

- Technology enhances the speed by which companies can penetrate households. This should be a strong driver of growth in India.

- It is our view that companies with the appropriate consumer preference awareness, price point and localised market knowledge are likely to benefit significantly from policy initiatives and reform such as GST.

- The potential for increasing earnings growth, given the tailwinds of spending power, youthful demographics and rising wealth through skilled employment, are mind boggling

- With consumption spending set to accelerate significantly, it is likely that a “virtuous circle” of efficiency, scale and profitability commences for companies catering for shifting consumer demands.

CONCLUSION

The future appears bright for consumer branded companies operating in India who know their customer and can cater for changing tastes and preferences of a local customer base. However, the demographic dividend can pass India by if policy and reform agendas do not focus on employment, upskilling labour and education.

A significant opportunity awaits if the dividend can be harnessed appropriately.

———————

India Avenue is a boutique investment management firm providing investment solutions that allow our clients to benefit from India’s remarkable growth story.

OUR BUSINESS

2005

The journey towards the “birth” of India Avenue originated in 2005, when ING Investment Management started a business in India as a separate division, utilising a practiced multi-manager philosophy in markets like Australia, and exported it to India. Three of our founders, Mugunthan Siva, Rajeev Thakkar and Sajjan Raut Desai worked together for INGIM (India), building investment strategies and structures, under this philosophy and applying them to Indian capital markets

2011

In 2011 our founders started discussing the possibility of building an investment firm with a capability to provide a focus on India as an stand-alone investment jurisdiction for foreign investors. The founders identified Australia and New Zealand as nascent markets for investing in regional locations, with the potential to accelerate given education and insights which the firm could provide.

2015

By 2015 the group of founders decided to work full-time on this concept to bring it to life. They did this by leaving their existing employment, thus exercising high conviction in the investment region of India as a long-term structural story for investors in Australia and New Zealand. Thus, the firm India Avenue Investment Management was registered and came to life in 2015 in Sydney, Australia.

2016

After building our business for a period of 12 months, our first fund, The India Avenue Equity Fund was launched on 6th September 2016, with strong service provider partners like Equity Trustees (RE), Mainstream (Fund Administrator), KPMG (Fund Auditor) and BNP India (Custodian).

NOW

India Avenue is now a boutique investment business firm, with clients spread across family offices, high net worth individuals, wealth advisers and financial planning firms. Our firm has focused on education and knowledge as a driver of investment behaviour and have taken a long-term approach towards Australian and New Zealand investors contemplating an allocation to India’s growth as part of their portfolios. Our firm has assets in excess of A$50m and the India Avenue Equity Fund is rated “Recommended”* by Lonsec and is available on multiple investment platforms across Australia and New Zealand.